Quarterback is the most important position in football, possibly in any team sport, because of the increasing emphasis on the passing game in today's NFL. Sustained success is almost impossible without good quarterback play, although there are exceptions. The Broncos won Super Bowl 50 with a shaky Peyton Manning because of their dominating defense.

There are more NFL teams than there are quality quarterbacks. Even rarer are passers who can consistently win games with their arms. This scarcity puts QBs in an extremely advantageous position when negotiating contracts.

Despite favorable circumstances, the top of the market has remained fairly stagnant since Aaron Rodgers became the NFL's highest-paid player in April 2013 with a five-year, $110 million extension. It took nearly three years for Ravens quarterback Joe Flacco to surpass Rodgers as the highest-paid player by less than one percent in average yearly salary at $22,133,333. In less than half this time, Derek Carr has become the NFL's first $25 million player with his five-year, $125.025 million contract extension from the Raiders. Overall, the top of the quarterback market has gone up 13.7 percent from when Rodgers signed four years ago.

However, high-end quarterback contracts have failed to keep up with the growth in the salary cap and franchise tags. The salary cap was $123 million at Rodgers' signing. It has grown to $167 million this year, a 35.77 percent increase. The franchise tag, which is an accepted measure for high-end salaries at the respective positions, has increased even more. The quarterback non-exclusive franchise tag was $14.896 million in 2013. The current $21.268 million non-exclusive number is almost 43 percent greater. Adjusting Rodgers' existing contract into the current salary cap environment and to reflect franchise tag growth puts him at approximately $29.85 million and almost $31.5 million per year.

There are a variety of factors responsible for the high-end quarterback market lagging behind these measures.

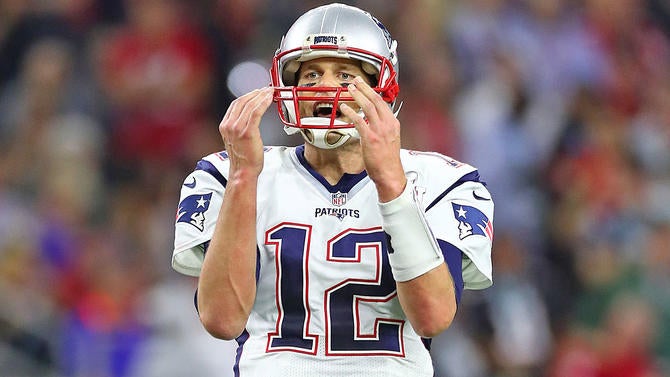

The Tom Brady approach

Tom Brady became the highest-paid player (by average yearly salary) in 2010 with a four-year, $72 million extension. Since then, he has taken a unique approach to contract dealings by consistently giving the Patriots hometown discounts instead of driving the market.

Brady's 2013 offseason renegotiation that freed up substantial cap room for the Patriots over the next two seasons was substantially below his market value. He received $33 million, which was fully guaranteed, in the first two years of the renegotiated deal instead of the $30 million he was scheduled to make in the remaining two years of his old contract signed in 2010. The final three years of Brady's pact (2015-17) for $24 million were guaranteed for injury at signing. These years also became guaranteed for skill (without an offset) by him being on New England's roster for the final game of the 2014 regular season. Right before those playoffs started, Brady gave up the skill guarantee in the three years. In exchange, $1 million was added to each of his remaining base salaries.

Brady signed a two-year extension in March 2016 for $41 million running through the 2019 season when he is 42. Before the extension, Brady was to make $9 million and $10 million in 2016 and '17, the last two years of the 2013 renegotiation. He received a $28 million signing bonus while lowering his '16 and '17 base salaries each to $1 million, which is $11 million more than he was scheduled to make over this time before the contract adjustment. Brady's 2016 salary was fully guaranteed. His 2017 salary guaranteed for injury became fully guaranteed on March 11, the third day of the current league year.

Brady is underpaid by practically every measure. His new pact can be viewed as a four-year, $60 million deal. Another way to look at it is to focus on the new money Brady will receive through his contract maneuvers compared to what he would have gotten had he played out his 2010 contract, which was set to expire after the 2014 season. There is $71 million of new money over five new contract years for an average of $14.2 million per year.

The NFLPA probably hasn't been happy with Brady's willingness to undercut the market with his contracts but would never express a negative opinion publicly about the dealings of such a prominent player. The approach has paid dividends for Brady in allowing the Patriots to assemble a more talented roster than they would have otherwise, which has resulted in two more Super Bowl rings since starting the process.

Brady hasn't started a trend among upper-echelon quarterbacks by taking a discount. Eli Manning, Philip Rivers and Ben Roethlisberger signed lucrative extensions in 2015 as 33- and 34-year-olds heading into contract years.

Unwillingness to fully exploit contract leverage

Other quarterbacks besides Brady haven't taken advantage of leverage. It just isn't to the same degree as Brady.

Carr acknowledged in the press conference after his extension that he left some money on the table so it would be easier for the Raiders to retain other key players, such as guard Gabe Jackson and reigning NFL Defensive Player of the Year Khalil Mack. He only minimally raised the bar with a 1.8 percent increase in average yearly salary over the five-year, $122.97 million extension -- $24.594 million per year -- that Andrew Luck signed with the Colts last June.

Carr fell short of Luck in a couple of key contract metrics. Although Carr's $70.2 million of guarantees is the second most in an NFL contract, they are almost 25 percent less than Luck's $87 million. It's only $200,000 more than Broncos outside linebacker Von Miller received last July in becoming the highest-paid non-quarterback. Carr's $40 million fully guaranteed at signing doesn't even put him in the NFL's top five among quarterbacks in this metric.

The Broncos got Peyton Manning at a discounted rate because of how he handled negotiations after the Colts released him in 2012. A dozen teams reportedly inquired about Manning once he became available. He narrowed his choices down to four and picked his destination before negotiating a contract instead of letting Tom Condon, his agent, leverage the considerable interest, which reportedly included a $25 million per year offer from the Titans, into a blockbuster deal. Instead, he still briefly set the salary bar with his five-year, $96 million deal.

A more conventional approach to free agency by Manning would have helped Drew Brees, another Condon client, even if he didn't reach the $25 million per year mark. Presumably, Manning eclipses the $20 million per year Brees got from the Saints as a franchise player a few months after he joined the Broncos. Manning's enhanced deal likely would have become the salary floor for Brees' contract.

NFL teams are fortunate high-caliber quarterbacks routinely sign extensions instead of playing out contracts. These types of quarterbacks would never hit the open market because of franchise tags. Nevertheless, Cam Newton and Russell Wilson are excellent examples of the benefits teams receive with early deals.

Newton and Wilson joined the ranks of the highest-paid players with extensions from the Panthers and Seahawks averaging $20.76 million (including $60 million in guarantees) and $21.9 million (with $61.542 million in guarantees) during the 2015 offseason. Wilson showed dramatic improvement as a pocket passer while carrying Seattle's offense for stretches of the 2015 season. He had an unprecedented five-game run from Week 11 to Week 15 where he threw 19 touchdown passes without an interception while completing 74.3 percent of his passes for a 143.6 rating. Newton won league MVP honors while leading the Panthers to a Super Bowl berth with the NFL's best regular-season record at 15-1.

An exclusive franchise tag for $25.94 million would have been necessary for both Newton and Wilson in 2016 without the extensions in place. The exclusive tag and their career years would have given them leverage for long-term deals averaging more than $25 million with over $75 million in guarantees. Luck could have leveraged their deals into a more lucrative contract than he actually signed, which in turn would have helped Carr.

The power of the franchise tag

The franchise tag is a powerful management tool that prevents players from receiving fair market value and generally depresses salaries. It is essentially a high-salaried, one-year "prove it" deal where players incur the risk of serious injury and poor performance again after already playing out their contracts when an agreement on a long-term deal can't be reached.

High-quality quarterbacks rarely receive franchise tags. The exclusive designation is primarily given when a franchise tag becomes a necessity so an offer sheet can't be solicited from other teams. A long-term deal is usually reached before playing under a franchise tag is a realistic possibility. Kirk Cousins is the only quarterback designated a franchise player in the past 10 years that didn't sign a long-term deal. After playing the 2016 season on a $19.953 million non-exclusive franchise tag, Cousins was designated by the Redskins as a franchise player for a second straight year at $23.943 million, a 20 percent increase over the previous year's amount, as mandated by the collective bargaining agreement. An exclusive tag was used this time.

Brees is a perfect illustration of the franchise tag's impact on salaries. When tagged in 2012, Brees was coming off the most prolific season of any quarterback in NFL history. In addition to shattering Dan Marino's single-season yardage record in 2011 with 5,476 passing yards, Brees set marks for completion percentage (71.2 percent), completions (468), 300-yard games (13) and consecutive 300-yard games (seven).

Brees became the NFL's first $20 million player with a five-year, $100 million contract. The deal only came after acrimonious negotiations led to Brees filing and winning a grievance against the Saints clarifying whether franchise tags applied across teams or were specific to teams.

Just imagine the type of contract a healthy, 33-year-old Brees could have gotten on the open market without the existence of franchise tags considering the Titans were reportedly willing to give a 36-year-old Manning, who missed the 2011 season because of multiple neck surgeries, $25 million per year. This Brees contract would have paved the way for Rodgers to take the quarterback market to unprecedented heights.

Brees recognized the power of the franchise tag before being given one by the Saints. He was a named plaintiff in an antitrust lawsuit against the NFL during the 2011 lockout. As part of the lawsuit settlement talks, he wanted an exemption from the franchise tag for the rest of his career but eventually relented.

The rookie wage scale effect

The 2011 CBA drastically reduced salaries for early first-round picks by implementing a rookie wage scale. The impact its creation has had on the top of the quarterback market shouldn't be overlooked.

The new system put an end to the practice of unproven commodities being paid near the top of their positional markets thanks to the inclusion of easily achievable salary escalators and incentives in their contracts. Additional money could also be earned with extraordinary achievements (All-Pro or Pro Bowl selections, ranking high in the NFL in a particular statistical category, NFL or Super Bowl MVP, etc.).

Sam Bradford's six-year contract worth a maximum of $86 million set a record with $50 million guaranteed when he was the No. 1 overall pick in 2010. A year later, Newton signed a fully guaranteed four-year, $22,025,498 deal, which included a $14,518,544 signing bonus, as the top pick in 2011. Newton's six-year contract would have likely had a base value of $86 million with a maximum of $95 million with $55 million guaranteed if the system had remained the same. Luck's six-year deal as the No. 1 pick in 2012 probably would have had a base value in the $95 million neighborhood where close to $60 million was guaranteed. The maximum value could have approached $105 million.

The latter years of these contracts typically become unmanageable for teams when draft picks were highly productive because of astronomical cap numbers from earning close to the maximum value. Some teams would compound the problem by restructuring rookie contracts for immediate cap relief, which would raise the cap numbers in remaining years.

This practice led to immense leverage for the player where the extremely large cap numbers forced a team to reset a positional market on an extension with a player-friendly structure or let him become an unrestricted free agent once his rookie contract expired because use of a franchise tag was impractical. For example, the Lions made wide receiver Calvin Johnson, the second overall pick in 2007 NFL Draft, the richest non-quarterback on a seven-year, $113.45 million extension in 2012 with $53.25 million fully guaranteed at signing. It would have been virtually impossible for the Lions to franchise Johnson at over $25 million when his rookie contract expired after the season and lowering his 2012 salary cap number, which was slightly over $21 million, was a necessity.

The Panthers might have been facing a similar predicament with Newton. It's conceivable that his franchise tag when his contract expired after the 2016 season would have easily exceeded the exclusive quarterback number of $25.98 million since his figure probably would have been based off 120 percent of his 2016 cap number. Newton's timing for an extension would not have come at a better time following his MVP and Super Bowl appearance. He likely would have been in a position to raise the salary bar for quarterbacks with an extension until Luck eclipsed it the following year, which would have been this offseason.

The litmus test for quarterback salaries

Quality quarterbacks almost never become unrestricted free agents. Cousins could be one next offseason if he plays under another franchise tag. The Redskins designating Cousins as a franchise player for a third and final time in 2018 at almost $34.5 million seems implausible. Another option would be using a transition tag for $28.73 million instead, which would only provide a right to match an offer sheet.

There has been speculation that Cousins could get $30 million per year on the open market given the shortage of good quarterbacks. Cousins signing in free agency would likely be a game changer for quarterback salaries even if he falls short of the mark. It would be the beginning of a dramatic shift at the top of quarterback market. Cousins' contract would be the starting point for the new deal Rodgers is expected to sign with the Packers in 2018 when there are two years left on his current deal. The Falcons will likely extend reigning NFL MVP Matt Ryan next year as well since he will be in a contract year.